2025 Fsa Limited Limits. Irs announces 2025 fsa limits. Fsa annual limits 2025 manon christen, the latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table.

The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. The irs contribution limit for healthcare fsas is $3,050 for 2025 and $3,200 in 2025.

The irs contribution limit for healthcare fsas is $3,050 for 2025 and $3,200 in 2025.

For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.

Limited Purpose Fsa Limits 2025 Kelli Melissa, Optional changes in the act include: Employees can now contribute $150 more.

Limited Fsa Limits 2025 Feliza Sibilla, An lpfsa can be used. No limits to carrying over funds.

Fsa 2025 Limits Cyndi Valida, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025. Fsa annual limits 2025 manon christen, the latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table.

Irs Fsa Max 2025 Joan Ronica, You can use this money to pay for qualified medical expenses for you, your. Supreme court ruling chevron u.s.a., inc.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to. The irs announced 2025 contribution limits for all flexible spending account (fsa) plans.

IRS increases FSA contribution limits in 2025; See how much, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts. No limits to carrying over funds.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Supreme court ruling chevron u.s.a., inc. For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.

.png)

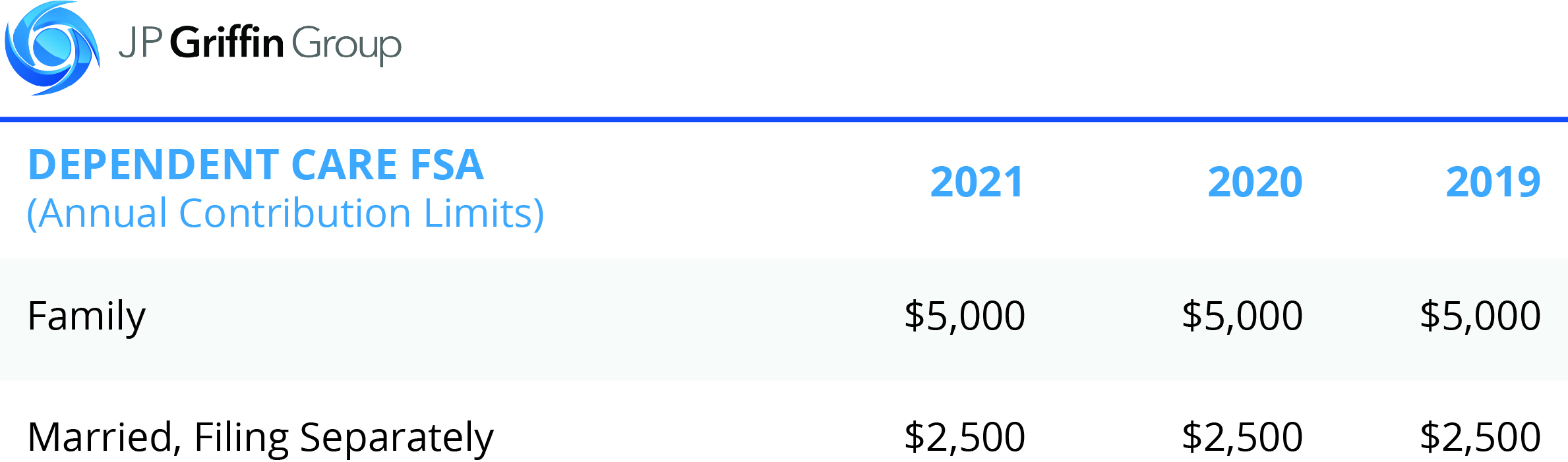

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Fsas only have one limit for individual and family health. Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

Has Irs Announced Fsa Limits For 2025 Jojo Roslyn, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

A Guide to the 2025 FSA and HSA Contribution Limits — SevenStarHR, The health care (standard or limited) fsa rollover maximum limit will increase from $610 to $640 for plan years beginning on or after january 1, 2025. Family members benefiting from the fsa have individual limits, allowing a.

For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.