Employee Mileage Reimbursement 2025 Uk. Discover the latest hmrc mileage rates for 2025 and learn how to easily manage and calculate your business travel expenses to ensure compliance and fair. If you are entitled to your own car for commuting purposes, the 2025 tax legislation states that the maximum amount you can deduct is €0.28/km if you drive your own car, and €0.21/km if you drive a company car.

Hmrc announced the 2025/2025 mileage allowance rates, which remain unchanged from last year. These rates only apply to employees using a company car.

Maps represent the maximum tax free mileage allowances an employee can receive from their employer for using their own vehicle for business journeys.

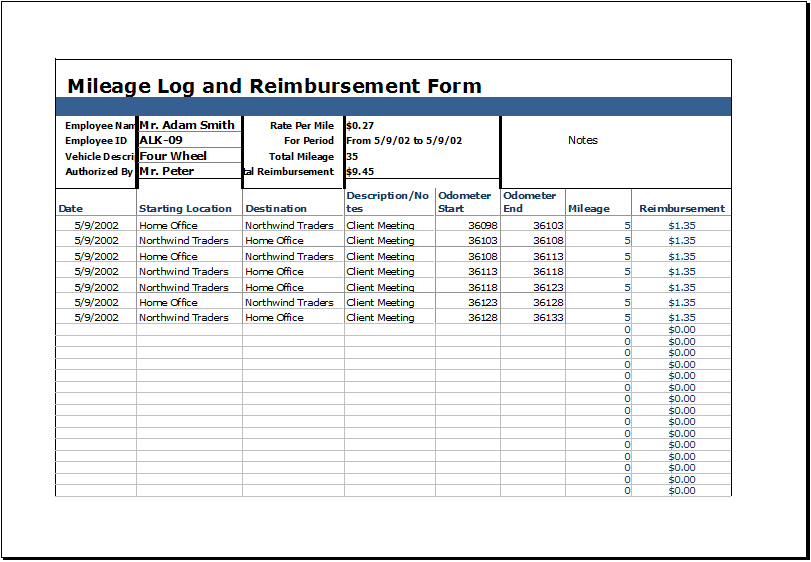

Mileage Reimbursement 2025 Form Excel Esta Alexandra, This blog aims to offer a complete guide on everything you need to know regarding hmrc mileage reimbursement rates in 2025. This detailed guide will explore how to calculate mileage reimbursement, the latest irs.

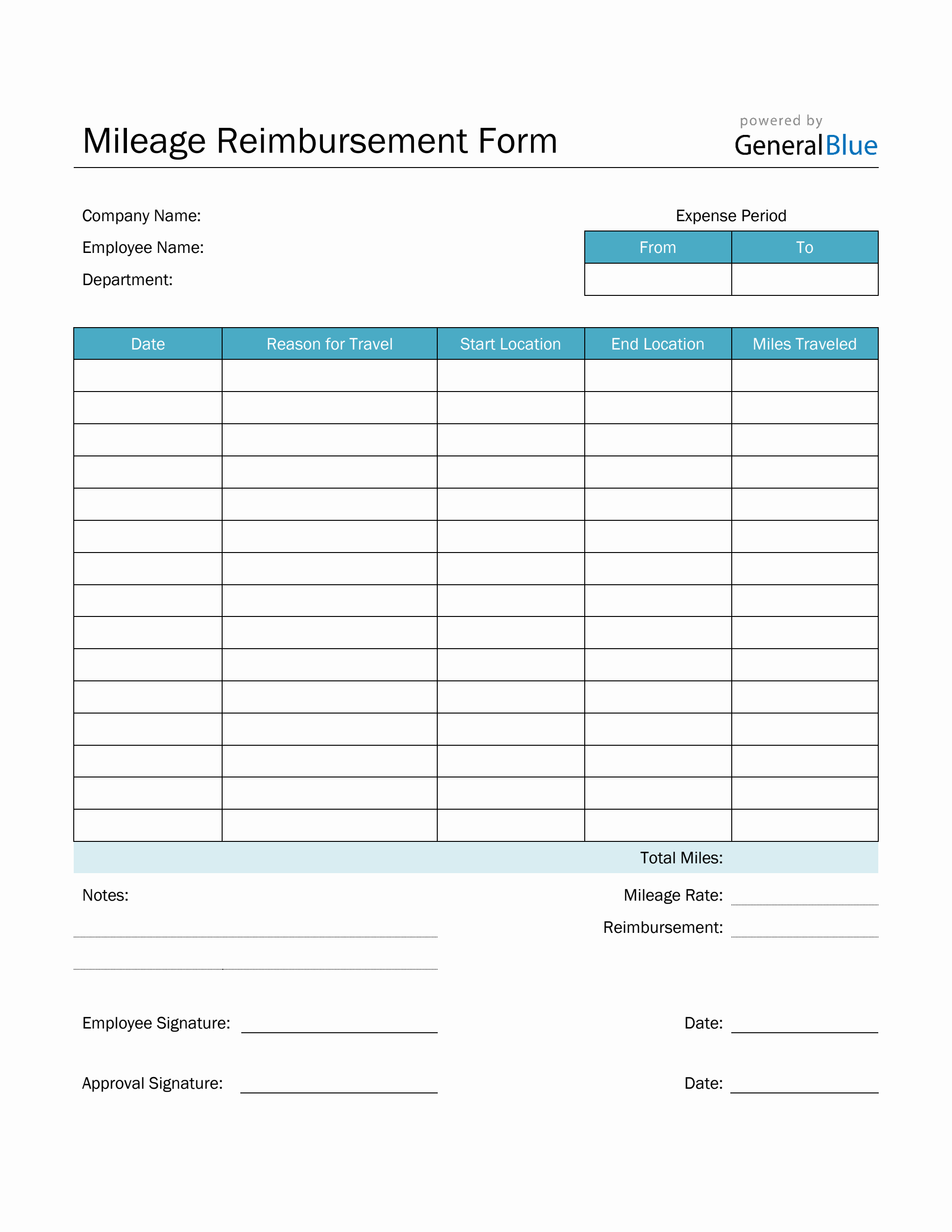

Mileage Reimbursement Form in PDF (Basic), You’re allowed to pay your employee a certain amount of. Timeero provides accurate mileage calculations, which are necessary to avoiding disputes and guaranteeing fair compensation.

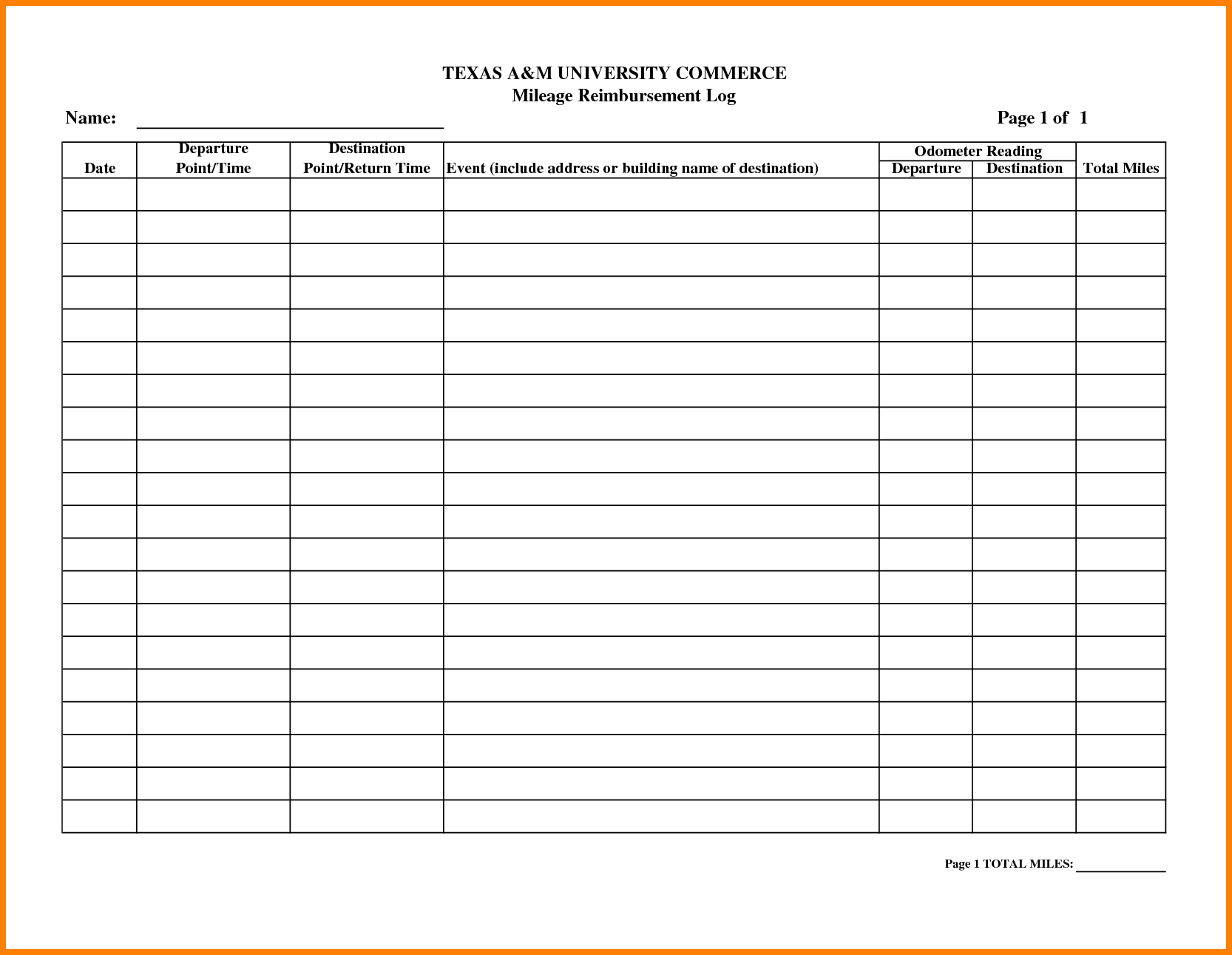

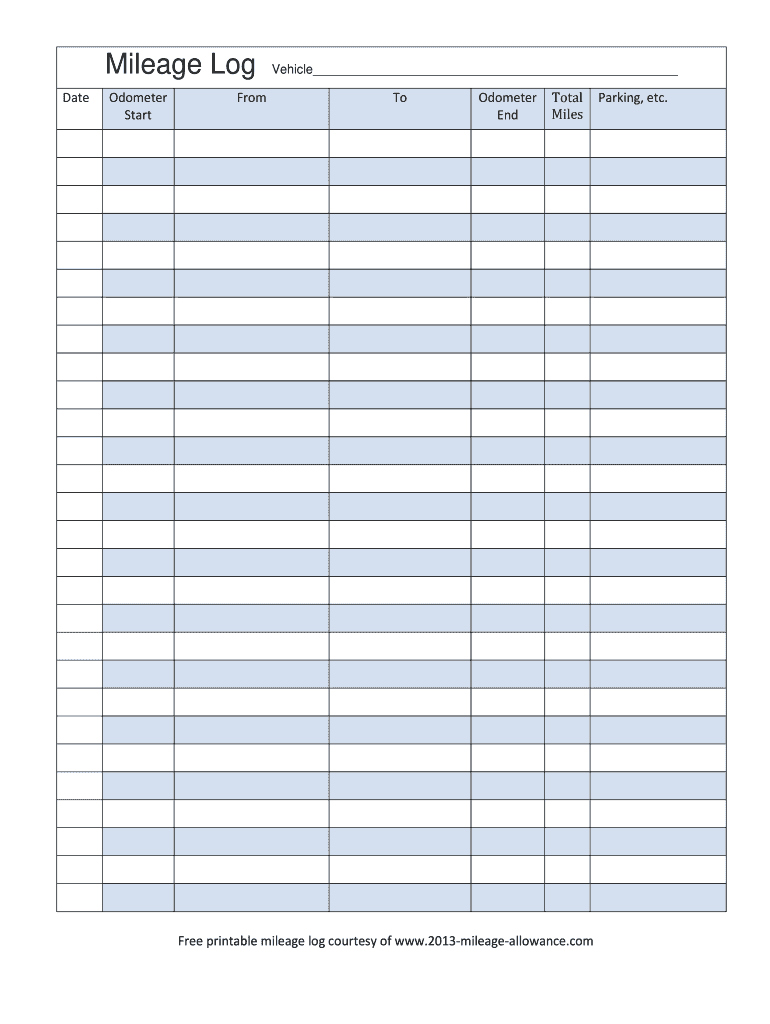

Mileage Spreadsheet Uk Google Spreadshee mileage log spreadsheet uk, Hmrc mileage reimbursement and claim rules for 2025/2025. A mileage allowance is considered to be one of the following:

Mileage reimbursement form 2025 Fill out & sign online DocHub, You’re allowed to pay your employee a certain amount of. Passenger payments — cars and vans.

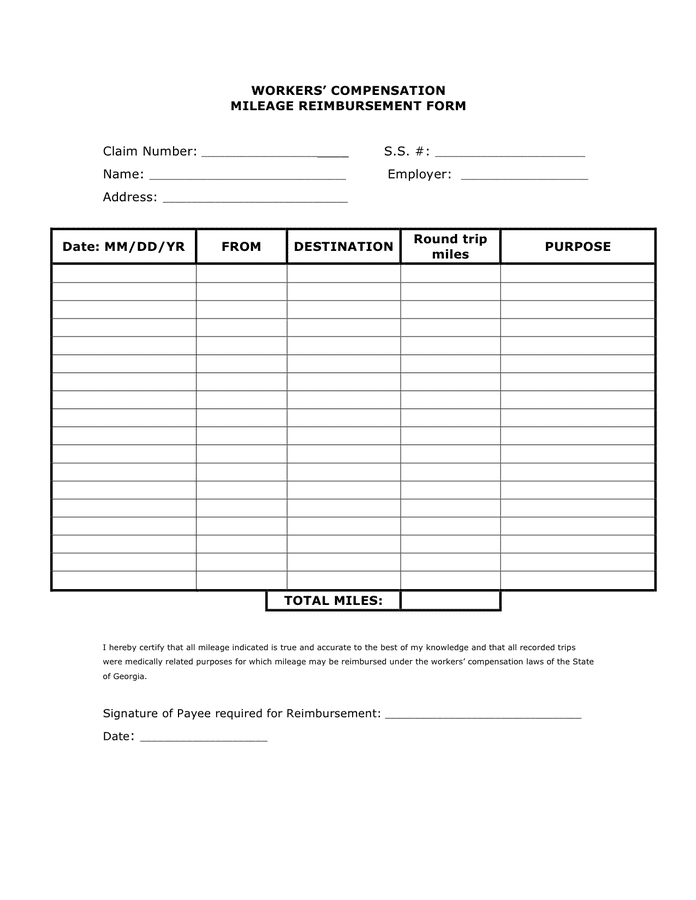

Workers' compensation mileage reimbursement form in Word and Pdf formats, With the rapid rise in petrol prices in 2022, there have been numerous calls to increase the approved mileage rates payment (amap) to employees and volunteers driving their own car from the current rate of 45p per mile (for the first 10,000 miles) which has been in place since 2011. Discover the latest hmrc mileage rates for 2025 and learn how to easily manage and calculate your business travel expenses to ensure compliance and fair employee reimbursement.

Mileage Reimbursement Forms charlotte clergy coalition, Employers, however, can pay their employee any amount per mile but anything above 45p per mile will be classed as benefit and will need to be reported on a p11d and then taxed. It does not matter if your employee uses more than.

Mileage Rate Reimbursement 2025 Uk Xena Carrissa, Find out what you can claim for mileage for the 2025/25 tax year. If you incur business mileage using your private vehicle as an employee, you can receive mileage allowance payments (maps) from your employer for your mileage expenses.

Mileage Spreadsheet Uk Google Spreadshee free mileage spreadsheet uk, Passenger payments — cars and vans. What the 2025 hmrc mileage rates and what journeys can employees claim?

Mileage log 2025 Fill out & sign online DocHub, The current allowance set by hmrc, hm revenue and customs (hmrc) is 45p per mile up to the first 10000 miles and 25p per mile thereafter. Travel — mileage and fuel rates and allowances.

Employee Expense Reimbursement Template, Enter miles this tax year. Reimburse employees for business travel in their company cars.

Discover the latest hmrc mileage rates for 2025 and learn how to easily manage and calculate your business travel expenses to ensure compliance and fair.